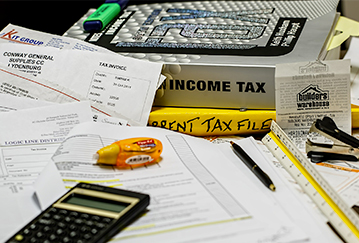

FILE : Withholding: last line-item!

According to recent polls, it seems expected by a majority of the French, the reform of withdrawing is not favorable with business leaders. And for reason ! Who looks forward to, without counterpart, playing the role of collector for the account of the State?

Nobody. But it’s there, after an ultimate psychodrama, the doubts of the President of the Republic seemingly lifted, the withdrawing will be entered good and well in vigor on the 1st of next January.

He will come back to you, from this date, to take, on the remunerations of your salaries, your income taxes and reverse it to the Public Treasure.

The amount of withdrawal is dependent on a tax that, for each of your salaries, you will be communicated by the administration through the famous nominative social declaration.

Stay assured that everything is working well and that your employees have understood that this reform is going to have an impact on their pay slip.

Also stay hopeful that the inevitable bugs will not be too many and will not put certain difficulties on your salaries.

In any case, the Cabinet is at your side to help you to manage this new constraint and, if you wish, to learn with you the possibility to indicate withdrawal, that is to say, to simulate the impact of this restraint on payslips of the last months of the year before the start of January 2019.